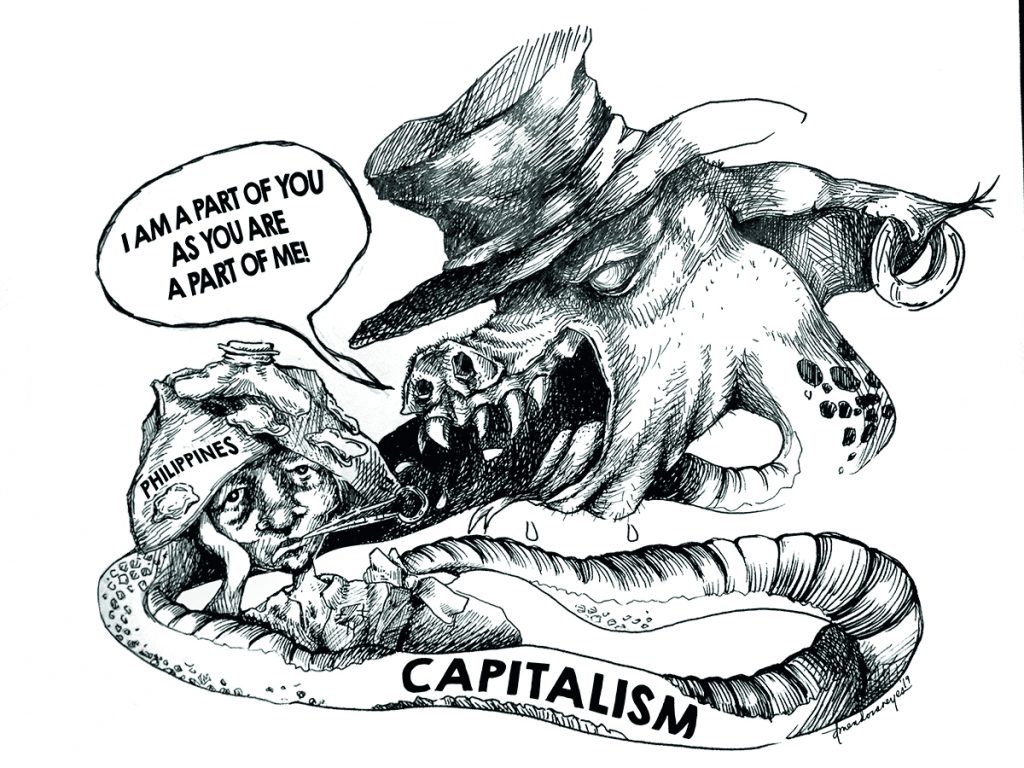

The Philippines has had a healthy GDP growth for almost a decade, but it is pretty clear that this has resulted in the rich getting richer, more than the poor getting less poor

The end of the Cold War 30 years ago was seen as an ideological victory of capitalism over communism. This left capitalism as the default ideological and economic system dominating the world. Some countries retain socialist features, but there is none that I know of where private property is disallowed, and where the state owns and operates all factors of production (including land and real property), which is the bottomline Marxist definition of communism. Since that triumph, where has capitalism brought us?

Capitalist societies believe in the sanctity of individual freedoms and civil liberties, and the incentive of meritocracy. Communism didn’t have freedoms, because not only could the individual not own anything; he had to do as he was told by the state. In most cases, he could not even choose the nature of his work. The idea of meritocracy was that capitalism (theoretically) offered opportunity to the individual: If you work hard, you will succeed. Under communism, the state makes you work. Any value you create doesn’t belong to you personally, so there is no such thing as success. You couldn’t even get promoted, because there would be no hierarchy. Everyone is theoretically equal under communism.

Communism was designed, ultimately, to attain (or force) social and economic equality, in the belief, rather well supported by history, that capitalism effectively promotes the opposite, inequality.

Ironically, despite the collapse of Communism, the Philippines, 30 years later, still has a Communist insurgency (the state would say “terrorism”) problem. The Communist Party of the Philippines (CPP) is avowedly Maoist, despite their original patron, China, having abandoned its own Maoist/communist economic principles as far back as 1979, in favor of almost totally unfettered capitalism. China’s ruling elite still calls itself a Communist Party, more out of inertia than anything. The CPP has long faded into political irrelevance, and they represent more of a peace and order problem than an ideological movement. Nevertheless, their analysis of Philippine society remains relevant today.

The Philippines is nominally capitalist, although some, like CPP founder Jose Maria Sison, insist that our society never fully emerged from feudalism, which was the previous stage. The main difference between capitalism and feudalism is that in capitalism, the elite class is not hereditary royalty, but the bourgeoisie, who attain political power through economic power, rather than through inheritance, lineage, and monopoly of state power. Given the preponderance of family dynasties in politics and business in the Philippines, you can see that Sison’s arguments have some weight. For the sake of brevity, however, let’s call it a capitalist system with feudalistic features.

The idea of communism, as set out by Marx, is that the working class would inevitably overthrow the ruling elite through revolution, in order to create a single, equal, and egalitarian society. This society (initially through the state) should own and control all factors of production, including land and machinery, and manage them according to a central plan. The idea was that the state would eventually wither away, as there would be no further need for it, as individual communities would govern themselves.

The 1987 Philippine constitution protects such key capitalist principles as private property and civil rights. What we have now is an almost extreme example of what post-Marxists called the “late capitalist state,” the principal features of which are the multinational nature of corporations, globalized markets and labor, mass consumption or consumerism, and free intranational capital flow.

As Marxist analysis predicted, inequality has been magnified. In essence, the working class, the great majority of the population, are almost wholly disenfranchised by the hegemonic economic and political power of the ruling elite. All surplus value generated by working class labor, or “profit,” goes not to the workers, but to the bourgeoisie. In the case of the Philippines, that bourgeoisie is a tiny part of the population. The figure being bandied about these days is that 70 percent of our economy is owned and controlled by about 0.1 percent of our population. That’s pretty feudal. Let’s examine social classes in the Philippines.

My readings of the National Statistical Coordination Board (NSCB)’s Family Income and Expenditure Surveys (FIES) from 2015 and 2018, combined with similar data from the Social Weather Station, suggests rough dimensions of the Filipino social classes. Figures are rounded off, and will not add up exactly:

The Upper Class is composed of 22,000 families (more or less 100,000 individuals), or 0.1 percent of the total population with the lowest annual per capita income at P700,000.

The Middle Class consists of 4.7 million families (more or less 2.5 million individuals), 2.52 percent of the total population, with lowest annual per capita income at P60,000.

The Lower Class are 14 million families (more or less 70 million individuals), 74.3 percent of the total population, with lowest annual per capita income at P17,000.

The Poor (those under the official poverty line at the time) are made up by 4.05 million families (more or less 23.1 million individuals) or 22.3 percent of the total population, and this was divided into two:

Income Poor, with 2.5 million families, (more or less 12.5 million individuals), 12.6 percent of the total population, with annual per capita income at or higher than P12,577 (2018).

Food Poor, 1.55 million families (more or less 7.75 million individuals), 7.9 percent of the total population, with per capita income lower than P8,804 (2018).

Despite the inevitable errors in my reading, the basic proportions are there. Is capitalism responsible for these awful conditions? Perhaps it is not capitalism per se, but the kind of capitalist system that we have in the Philippines.

The principal problem with Philippine capitalism is that it breeds social injustice and inequality. Capitalism per se has not had the same result in places like Europe or Canada. The Philippines has had a healthy Gross Domestic Product growth of 6 or 7 percent per annum for almost a decade, but it is pretty clear, from other indexes, that this has resulted in the rich getting richer, more than the poor getting less poor.

Unlike traditional leftist theorists, I am not inclined to classify the ruling elite as absolutely evil, driven by greed, who consciously oppress the working classes. After all, you and I are members of the ruling elite. We didn’t choose to be, but neither did we choose to live our lives in a way that would ensure the continued poverty and suffering of others; nobody really does that. We’re just trying to make a living, like everyone else. But we have to acknowledge that capitalism leads to inequality because it is ultimately driven by greed.

Of course, we don’t call it greed, we call it (for instance) “profit maximization.” A property developer will build a 50-story building on a one-hectare lot, if he can, rather than a 25-story building, because he will be able to make twice the profit for the same land value. Also, because he has a greater economy of scale, he will be able to construct twice the number of floors for less than twice the cost. All capitalists are beholden to their shareholders, and the banks that they borrowed money from, to maximize profit. The principal limit to profit maximization is the amount of capital available to the developer.

By the same token, this same property developer would not be acting in the best interests of the banks and the shareholders if he paid the workers who will build the building more than the legally mandated minimum wage. In fact, he could be prosecuted for mismanagement, if he did this without the agreement of all stakeholders. He would be allowed to spend a small percentage on “corporate social responsibility,” but any other issues, such as the suitability of the project for the economy at large, or the environmental sustainability of the project, are rarely considered.

Nevertheless, our property developer, as long as he follows rules and laws, is, in some sense, the ideal capitalist, and they are few and far between. He is creating employment and economic activity. He is creating value and contributing to GDP. He earned his profit honestly. However, the norm in Philippine capitalism, unfortunately, is not so ideal. It is marred by gatekeeping, rent-seeking, monopoly, and corruption.

Gatekeeping is using legal power and control of resources to extract value—just a technical term for extortion. An example of gatekeeping by a local feudal warlord would be like this: A province produces a major cash crop, say, rice, that is exported to Manila. The governor establishes a police checkpoint with a machine gun at the principal highway leaving the province, on the pretext of security and road safety. The policemen (and I use this term loosely) manning the checkpoint demand P5,000 from every truck that needs to pass the checkpoint. If the driver does not pay, the policemen will impound it, and conjure a violation (most of which are probably applicable, in truth): the truck is overloaded, the tires are worn, the taillights aren’t working, there is no permit for this or that, etc. An average of 100 trucks a day are forced to pay this amount, or they cannot pass. Thus, the governor collects P500,000 a day, or about P180,000,000 a year. He pays some percentage to the policemen, and whoever else, to shut them up. What value did he provide in exchange? He let the trucks pass.

This is a documented example from history, by the way. I changed the crop and adjusted the amounts involved for inflation, but this really happened, and the warlord in question is still around.

“Rent-seeking” is a term used in economics and political science, and means the use of resources to gain profit without creating corresponding value, or to create disproportionate profit for that value. “Rent” is the economic term for any payment greater than the cost of providing the product or service. Some people use rent-seeking and gatekeeping interchangeably, but the difference is that rent-seeking is not pure extortion; it is actually legal, and some value is created. This is most apparent in the issue of monopolies, particularly utilities and public infrastructure.

Here is rent-seeking I have witnessed personally, at the Navotas fishport. When the boats come in, there is a line of guys standing on the pier, with big galvanized iron tubs and weighing scales. These guys have paid money in order to be licensed as buyers. No other persons are allowed to stand on the pier and negotiate with the fishermen; in fact, there is a stout metal fence with a gate preventing anyone from getting any ideas about free enterprise. There is, of course, a reason for this, which is that the space is limited. Only so many people can fit on the pier. If they let too many in, it would be disorderly and dangerous. The licensing is legal.

When the boats come in, the fishermen are not allowed to sell to anyone else but the licensed buyers. The buyer fills his tubs, and pays the fishermen, for example, P50 per kilo. He then drags the tub through the gate, around 50 meters, to another line, and sells the same fish for P100 per kilo to the traders. The traders have also paid a fee to join this line, and the number of slots is limited. The traders load the tubs into their vehicles, and then drive to wet markets and supermarkets around the city, where they will sell the fish for P200 per kilo, or consign it for P300 per kilo. The ultimate consumer will pay maybe P400 to P500 per kilo.

That, my friends, is rent-seeking capitalism in action. Profit was maximized at every level by preventing or limiting competition. But even with that, many of the participants are not many steps above poverty. If you think the licensed buyers are millionaires, you have no idea what they pay for those licenses. If you think the traders with the vehicles are millionaires, you have no idea of their capital risk in consigning the fish. When those fish get returned, unsold, pretty much spoiled, because of lack of cold storage, they will have to eat the unrealized investment— and the fish, as well, if they still can. This is why you should probably not eat fish at a restaurant in the Navotas fishport.

This happens with almost all agricultural produce in the Philippines. In fact, the average percentage of the final retail price that the farmer or fisherman gets is 7 percent. P7 per P100. Typically, his cost per unit is 40-55 percent, so his profit on each P7 is just P3.50. This would be a decent margin if the producer were at an industrial volume, but if he is not, he remains firmly below the poverty line.

The average number of middlemen in the value chain between the producer (farmer or fisherman) and the consumer is eight. It can be as many as 22 in places. Some of these middlemen actually create value—for instance, logistics, aggregation, processing, cold storage, and the like—but in almost every case, they practice rent-seeking. Thus, the difference between the farmgate price and the final consumer price is large, ranging from a minimum of about 100 percent to as much as 300 percent.

Here are some examples of farmgate price vs retail price, with markup. These numbers are all current numbers from the Philippine Statistics Authority:

Carrot P25.57 farmgate vs retail P80, or 212 percent

Sitao (stringbean) P26.92 farmgate vs retail P80, or 197 percent

Tomato P19.70 farmgate vs retail P80, or 306 percent

Cabbage P19.39 farmgate vs retail P60, or 209 percent

Eggplant P21.06 farmgate vs retail P50, or 137 percent

Native pechay P30.98 farmgate vs retail P60, or 94 percent

Palay (unmilled rice) P19.64 farmgate vs well-milled rice retail P41.22, or 110 percent

Corngrain P13.86 farmgate vs milled corn retail P23.79, or 71 percent

Hogs P110.52 live weight ÷ 65 percent pork yield = P170.03 vs retail P245, or 45 percent

Whole chicken live weight P72.86 ÷ 72 percent yield = P101.19 vs retail P160, or 58 percent

Note: Corn and rice are strategic foodstuffs, and thus the NFA buys at the highest farmgate and sells at the lowest retail. The livestock industries are relatively developed, so the gap between farmgate and retail is lower, actually close to ideal. The retail prices given are at wet markets. Grocery and supermarket prices are between 20 percent to 200 percent higher.

That’s agriculture. Industry is not much better. Public utilities, for example, have a very long history of rent-seeking. Try reading your electric bill closely, one of these days. You and I pay around US$0.20 per kilowatt hour, the 10th highest electricity rate in the world (if you don’t count a whole bunch of Pacific island nations that are statistical outliers), and the second highest in Asia, next to Japan (US$0.22). Compare this with the Indonesians, who pay a total of US$0.10, and Indians and Chinese, who pay US$0.08.

The actual charge for power generation, with profit built in, is usually half of the total charge you pay. The rest is distribution and a whole bunch of subsidies. In many other countries, the distribution and other charges are less than 20 percent, and sometimes so low, that they are not reflected in the bill breakdown.

Both generation and distribution in the Philippines are quite inefficient, because they are monopolies, and thus expensive. You and I are still paying today for mistakes made starting 30 years ago, when the governments at the time guaranteed that it would buy power from operators at sky-high rates, out of desperation, because it had failed to build enough generation capacity to keep pace with the economy. Power is in oversupply, a buyers’ market today, but we are still paying for the sellers’ market 30 years ago.

The rent-seeking in electricity distribution keeps pace with technology. Take solar power. If you install enough solar power in your home, you could be able to power everything during most days of the year. But at night, or if it’s cloudy and raining, you will of course get no solar power. In almost every other country in the world, you can install more capacity than you need during the day, sell it to the utility, and buy it back at night. This is an arrangement called net metering.

Let’s say your daytime consumption is 20 kWH, and your nighttime consumption is 30kWH. You could install enough panels to generate about 50 kWH during the 12 daytime hours. Thus, during the day, you will generate 30 extra kWH, and feed it back into the grid—through the very same connection that you get electricity from the grid in the first place. When your house is generating electricity instead of using it, the meter runs backwards by the same amount. In other words, the meter works both ways.

In almost every other country in the world, the government has agreed that in the case of solar, or any self-generation, the consumer will simply pay what the meter says, which is the entire amount of electricity that he got from the grid, less the amount of electricity he fed back into the grid. So if you feed 30 kWH a day into the grid, it’s a straight swap, kWH for kWH, for the electricity you will then use during the night. You can thus easily reduce your electric bill to zero. But, guess what: not in the Philippines.

In the Philippines, the ERC requires that you install another meter, for the outgoing electricity. The utility then sells you electricity on your original meter, at the total rate, but will only credit you for the electricity you put into the grid at generation charge, meaning about half or less what they are charging you for the very same electricity.

OK, you say. That’s not very fair, but since my total consumption at night is 30 kWH, I’ll put in enough panels to generate 100 kWH. That way, I’ll sell them more than twice the electricity I need, at half the price, and still zero out my electric bill. Not so fast: The Energy Regulatory Commission has made a rule that anyone who generates more at least 100 kW to sell to the grid is effectively an electric utility, and thus must get a franchise, and get all the regulatory compliances, the same as a power plant, including tax registration, environmental clearances and a business license. Sound fair to you?

Another example of using regulation to eradicate competition is the telecoms duopoly. The legal barriers in this case are also physical: the bandwidth available. The world standard for mobile telephony, GSM, today uses the frequencies between 700 MHz and 2100 MHz. That is, by definition, a limited resource. Since the duopoly bought up all their competitors, they have also come to control the majority of this bandwidth, which leaves very little room for a third player to enter and operate. The National Telecommunications Commission had to force them to “surrender” some of the frequencies, in order for the new player, Mislatel, to operate.

The duopoly has been bickering over frequencies since day one, and kept demanding more bandwidth from the government, claiming they need it to expand their services. This is only partially true. More bandwidth is indeed nice to have, but the real reason is to shut out other players, because real competition is something they can’t handle. That is the very essence of rent-seeking.

One of the major effects of rent-seeking is that it makes industries uncompetitive. As a result, we are losing on so many fronts, and our economy is not sustainable. That economy is driven by the two industries where we have a competitive advantage: overseas workers and BPOs. The end is in sight for BPOs, as artificial intelligence has become practical and implementable. Most of our economic activity today is consumerism, just as Marx predicted. That consumerism is anchored on the consumption of imported goods. Thus, a lot of the dollars our OFWs and BPO workers bring in gets spent in malls and goes right back abroad.

Our domestic agriculture is in a shambles. So much local produce is being replaced by imports, including pork, chicken, onions, garlic, tomatoes—because in other countries these products are industrialized, and therefore, much cheaper, even with logistics costs and import duties. I recently spoke to the head of a major food company that specializes in pork and chicken products. He told me that much as they would like to source everything locally, he can only manage maybe 20 percent, because the local supply is unreliable, erratic, does not meet specifications, and most of all, is more expensive. We no longer make our own shoes, our own clothes, and we are even importing cement to fuel our property boom.

So, if capitalism is so dysfunctional, what is the alternative? Certainly not communism, which does not appeal to me, even if it were still alive, which it is not. I suppose the answer is not that clear, except that we should at least start looking for an answer. It will probably be a form of capitalism, because that is dominant, and no one will want to change it. But perhaps there is a way to evolve capitalism into a form of social capitalism, so that it is less greed- (or “profit maximization”) driven, more egalitarian, promotes economic participation and free enterprise and thus produces more efficient and competitive industries that create value for more than a few.

The Philippines is by no means unique in the world when it comes to our economic situation. But it does not mean that we should accept it as our fate. We must change the way we do things, improve our system. We need to address the problem of inequality, because if we don’t, we will continue along the same path, which is that the rich continue to get richer, and the poor stay poor—or get poorer. At the end of that path lies social instability, class war, and failure as a nation. But, against the odds, I remain hopeful, because we are Filipinos: We always find a way. We just have to start looking for it. AD